The Hindu Businessline

Elections 2026Economy / The Hindu Businessline

India had been given a 30-day waiver in which to purchase Russian oil without attracting punitive tariffs

Representations regarding levy of multiple ancillary charges by shipping lines, carriers and their agents, have been received

April-January, India saw higher fertilizer output, imports of Urea, DAP, Complex, SSP and MOP - moving from 57 mn tonnes last year to 65 mn tonnes

Last week, refiners were directed to prioritise propane and butane for producing LPG, to be delivered only to Indian Oil Corporation, Bharat Petroleum Corporation and Hindustan Petroleum Corporation

Sources in the fertilizer industry said that urea plants, which make the fertilizer mainly on imported gas, are currently getting 30-50% of their requirement

Deepak Parekh, M Damodaran, S Ramadorai and S Ravi have joined the advisory board of the Prashanthi Balamandira Trust; the Trust supports education and healthcare programmes

India will not participate in the G7s effort to release crude oil stocks from the strategic petroleum reserves, say sources

Exporters seek APEDA help after 80 egg containers from Kochi to West Asia were diverted to Mumbai

Targeted inflation range for India is 2 to 6%, with 4% as the median rate

Stocks of InterGlobe Aviation (IndiGo) and SpiceJet fell 3.4% and 6.64%, respectively, on Monday, mirroring the performance of other airline stocks in the Asia-Pacific region

The company has already invested 180 crore in lubricant plant in Hisar (Haryana) with a capacity of one-lakh litres per day

The minister said FTAs are not limited to large industries but benefit a wide range of stakeholders, including farmers, fishermen, MSMEs and small businesses, by expanding access to global markets.

The Karnataka GCC Policy reinforces this intent, targeting global firms across technology, financial services, and engineering and manufacturing, a move that could enhance long-term office demand in smaller cities, including Mysuru.

The workforce has been modernised by hiring, reshaping contracts and offering exit options: Minister

Probe into Boeing 787-8 Dreamliner flight AI171 crash that killed 260 people nearing completion, Civil Aviation Minister K Rammohan Naidu told Rajya Sabha

Rising energy costs, disruptions in key export markets could impact domestic industry

Sitharaman stated that, with Indias inflation near the lower bound, the impact on it is not expected to be significant at this time

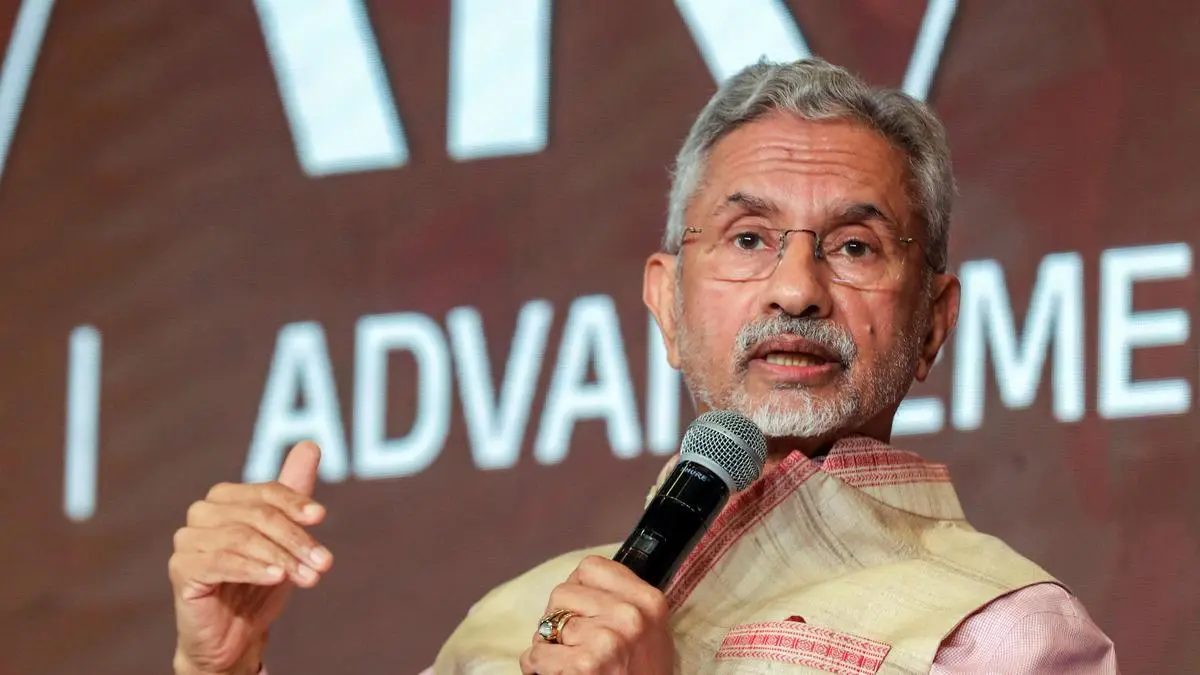

Where required, Indian diplomacy has supported endeavours of our energy enterprises in this volatile situation, the Minister said

The upcoming edition aims to deepen industry engagement and encourage practical dialogue on the future of airport development and operations

India, the world's second-biggest crude steel producer, imported 5.6 million metric tonne of finished steel during April-February, down 37.4% year-on-year

The latest batch of data on jobs, pump prices and the stock market suggests that Trump's roar has started to sound far more like a whimper

Stakeholders said that strengthening vessel registration, licensing and gear records within existing digital systems are critical to improve transparency and certification

Cancellations include nine arrivals and 10 departures

Elevated oil/gasoline prices with upside risk may turn sugar as key geopolitical commodity this year and next, says Michael Ferrari of Moby and AlphaGeo

The civil aviation ministry on Sunday said that due to the ongoing situation in the Gulf, flight operations have been impacted across several sectors

Brent spiked as much as 20% to $111.04 a barrel, the highest level since July 2022

The meeting is important as global trade has been disrupted first by sweeping tariffs imposed by the United States and now by the West Asia crisis triggered by the joint attack by the US and Israel on Iran

DFC CEO & US Treasury Secretary announced a detailed plan approved by President Trump to deploy maritime reinsurance, including war risk, in the Gulf region in close coordination with CENTCOM

Sustained crude upside could translate into 100150 basis points of gross margin pressure if companies do not pass on the costs, said Sandeep Abhange, Research Analyst Consumer & Midcaps at LKP Securities

Customs in Nhava Sheva and Mundra waive BTT levy of 1,000 per box to help exporters; but trade wants it to be implemented across India and retrospectively - from the day the the airlines suspended operations

After the launch of AIF in 2020, under which the beneficiaries get loans from banks at 6% interest as the Centre bears 3% interest subsidy

The lower-duty windows will help European car makers understand consumer appetite and operational viability

The flyover on Ganeshkhind Road was opened to the public after CM Fadnavis inaugurated it via video conference

Energy companies lead spending as outlay reaches 7.40 lakh crore in 11 months

Rising crude, LNG and freight rates could pressure steel prices and margins, says BigMint

Move follows Saudi Arabia and Oman opening airspaces to maintain regular services

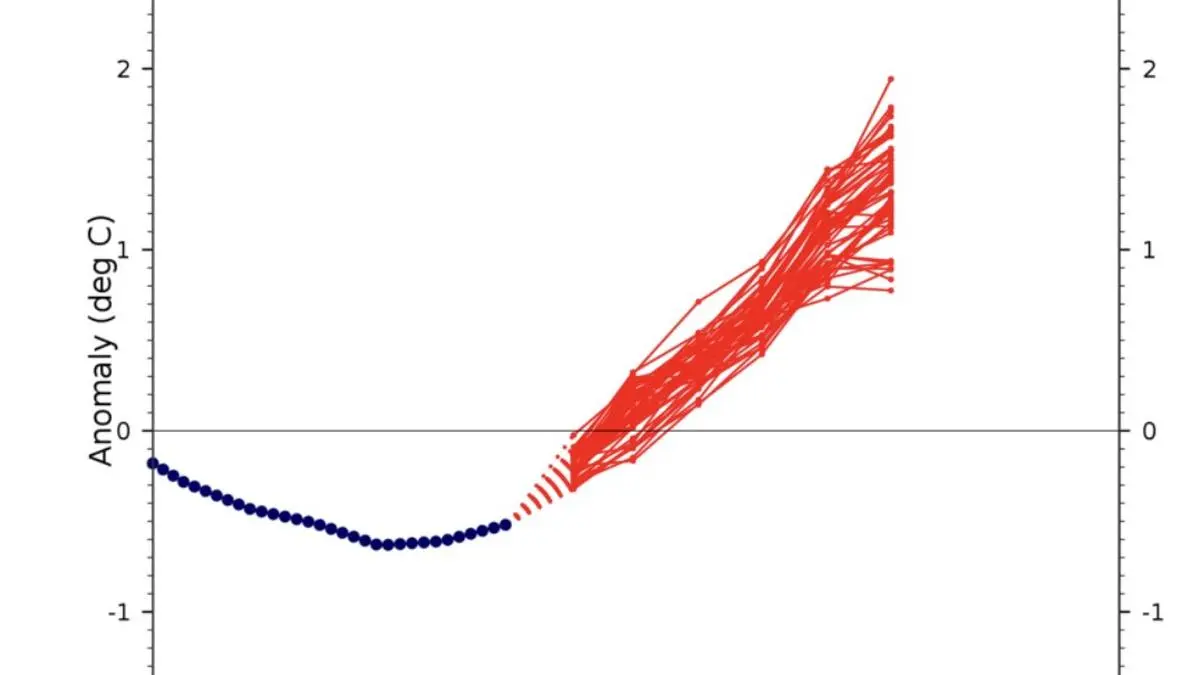

The Pacific in east has already started warming, support from the atmosphere above is also unfolding

The real question before Indian dairy is not whether it can grow without milk volumes, but whether it can grow fast enough in quality without compromising on safety, sustainability, or trust

The future of dairy in India can be based on understanding dairy rather than just producing it

Empowering rural India through commodity market access is a pragmatic approach, and not just a theoretical proposition

To ensure these products are genuinely advantageous, nutritionists are promoting the need for clear labelling and independent laboratory testing

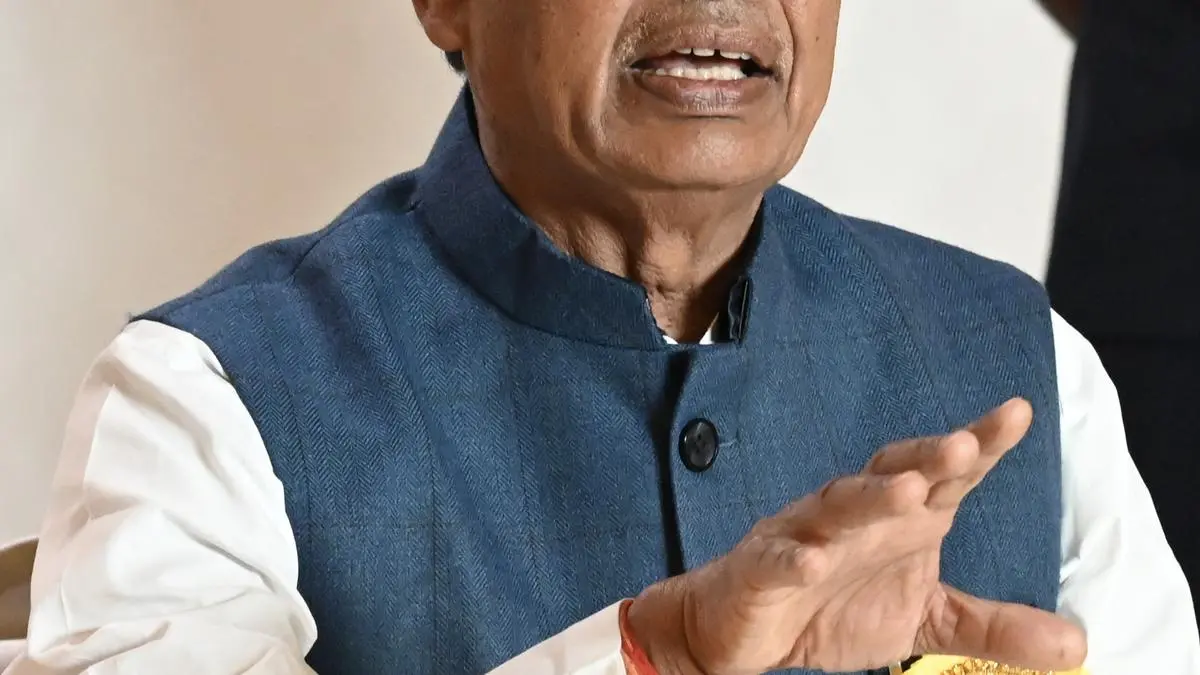

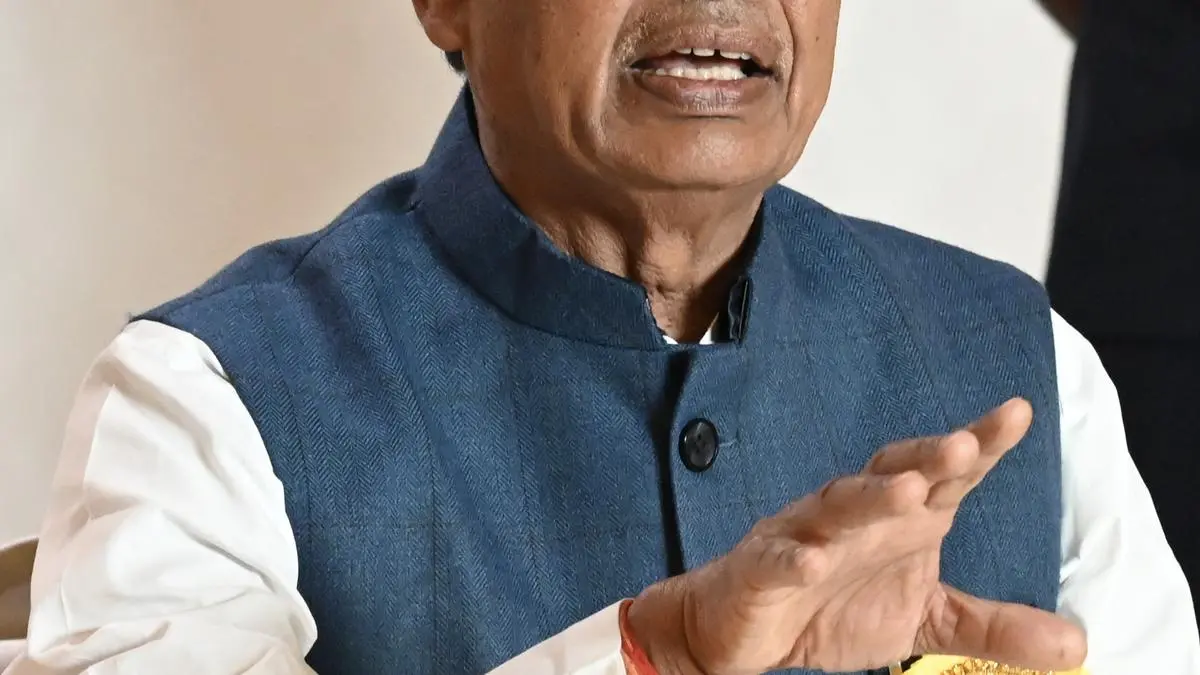

Government fine-tuning details of coconut promotion scheme, says Minister for Agriculture and Farmers Welfare Shivraj Singh Chouhan

Government fine-tuning details of coconut promotion scheme, says Minister for Agriculture and Farmers Welfare Shivraj Singh Chouhan

Cereals, especially rice, fruits, vegetables, spices, meat, dairy and beverages are all likely to be affected if the war goes on for a longer period, it highlighted

The notification further provides that carbon dioxide for green methanol production may be sourced from biogenic sources, direct air capture or existing industrial sources

As part of the SoP, each port will appoint a nodal officer at the level of head of department, who will be the single point of contact for addressing the issues coming up for consideration at ports

The conflict between the US-Israel alliance and Iran is intensifying as it heads into a second week, straining global supply chains and raising questions about price spikes not seen since the pandemic

With over 35 lakh MSMEs and around 45,000 crore in annual apparel and home textile exports, the summit focused on raising awareness among the regions sellers about the global opportunities

It said the surcharge would be $30 per TEU from the Mediterranean and Black Sea to the Red Sea for dry containers, and $50 per TEU for refrigerated containers

21 C

21 C