Foreign investors pull out Rs 21K crore from Indian equities amid Iran tensions

New Delhi: Foreign investors pulled out Rs 21,000 crore (around USD 2.3 billion) from Indian equities over the last four trading sessions amid de

Majority consensus reached on Irans next supreme leader

Clerical body says majority consensus has more or less reached but procedural hurdles remain

12 years on, renewed hunt for missing Flight MH370 comes up empty

Families urge Malaysia to continue search as latest deep-sea mission finds no wreckage

Tax savings FDs vs National Savings Certificate? Check details and rate of interest to choose what works best for you

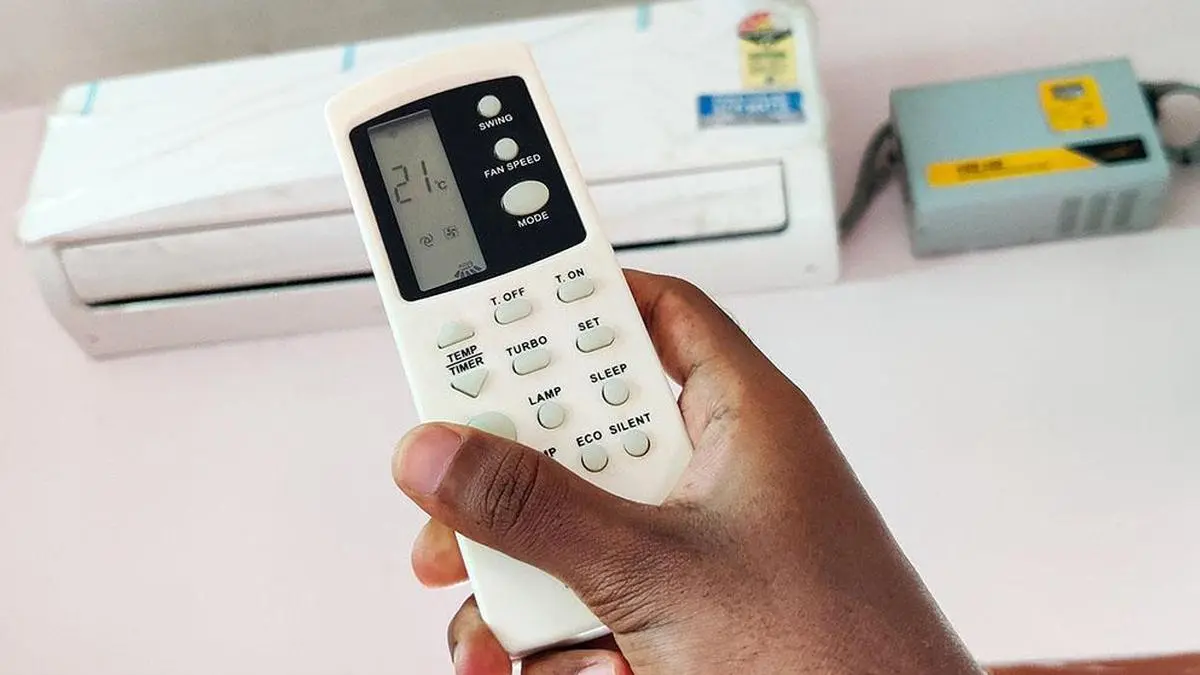

AC prices to rise 5-15 pc as expensive copper, weak rupee and new energy norms push costs

NEW DELHI, Mar 8: As the mercury starts rising, leading room airconditioner makers are increasing prices in the range of 5-15 per cent to offset

CPSEs capex nears revised annual target with a month to spare

Energy companies lead spending as outlay reaches 7.40 lakh crore in 11 months

AC prices to rise 5% to 15% as expensive copper, weak rupee and new energy norms push costs

The hikes, being rolled out between February and April, come just ahead of the peak summer season when demand typically surges

India, China should view each other as partners, not rivals: Foreign Minister Wang Yi

Both countries should stick to the direction set by Prime Minister Narendra Modi and President Xi Jinping to improve relations without interferen

Iran conflict could impact India's agricultural exports to West Asia

India's agricultural sector could take a major hit if the war in Iran continues for an extended period.

West Asia crisis, crude prices key factors for stock market movement this week: Analysts

Besides, global market trends and trading activity of foreign investors would also drive investors' sentiment

UAE air defences intercept incoming missiles and drones from Iran: Defence Ministry

The military response follows a wave of aerial threats targeting the Gulf nation

Solar Defence to invest 12,800cr in robots, UAVs and missiles

Solar Defence and Aerospace Limited has announced a massive investment of over 12,800 crore in deep tech projects.

Escalating tensions in West Asia to impact Indian, other steel markets: Report

Rising crude, LNG and freight rates could pressure steel prices and margins, says BigMint

Iran's president says his remarks were 'misinterpreted by enemy' - state TV

RBI updates AU Small Finance Banks move to Universal Bank

AU Small Finance Bank has received an important update from the Reserve Bank of India (RBI).

Global oil markets on edge as West Asia unrest triggers new energy shockwave

Crude oil prices have surged to near one-year highs as escalating conflict in West Asia threatens key supply routes, particularly the Strait of H

Mcap of 8 of top-10 most valued firms erodes by Rs 2.81 lakh cr; SBI biggest laggard

The combined market valuation of eight of the top-10 most-valued firms eroded by Rs 2,81,581.53 crore last week, with the State Bank of India tak

Market rout wipes 2.81-lakh cr off top 10 most valued firms

SBI takes the biggest hit as weak equities and geopolitical tensions weigh on Dalal Street

Smart agro-technologies workshop: CSIR showcases AI, IoT for soil and crop health in Kerala

CSIR organized a national workshop in Kumarakom, Kerala, focusing on smart agro-technologies for soil and crop health. The event showcased AI, Io

PM Modi to inaugurate two new Delhi Metro corridors: Key routes and how they will help commuters

Prime Minister Narendra Modi will inaugurate and lay the foundation stone for infrastructure projects worth Rs 33,500 crore in Delhi. This includ

AC prices to rise 5-15% as expensive copper, weak rupee and new energy norms push costs

Industry executives said while adjustments are unavoidable, they expect strong sales momentum this year, aided by forecasts of a hotter summer an

Cipla recalls over 400 cartons of cancer drug in U.S.: USFDA

The company is recalling the affected lot (271 and 164 cartons) due to failed tablet/capsule specifications, it stated

Fear, oil shocks and volatility: Why investor behavior matters more than ever

Indian markets face volatility due to global tensions. Investors often desire stability but markets respond to real risks like rising oil prices

Why US Customs can't process Trump tariff refunds

The US Customs and Border Protection (CBP) has said it can't comply with an order to process billions of dollars in refunds.

How passive investing could shape womens investment choices in 2026

Women are increasingly shaping Indias mutual fund landscape, with one in four investors now being female. As financial decision-making shifts, ma

Israel renews assault on Lebanon after Netanyahu promises 'many surprises' in next phase of war

The Israeli military said in a statement that it would not allow Iranian terrorist elements to establish themselves in Lebanese territory

'To take a little pressure off': Trump says on US granting permission to India to accept Russian oil

When asked about Bessents announcement on allowing some Russian oil sales to India, Trump said, If there were any moves, I would do it to relieve

5 IPOs to open this week. Check GMPs to track listing sentiments

Indias primary market will see five IPOs open next week, including four mainboard issues and one SME offering, but weak grey market premiums indi

10 smallcaps that delivered up to 25% returns in a week when 1,000 stocks fell

Despite a volatile week driven by geopolitical tensions and rising crude prices, several smallcap stocks bucked the broader market trend. While n

Trump tells Britain he does not need its help to win Iran war

Trump has repeatedly criticised British Prime Minister Keir Starmer suggesting this week that he helped uin the countries' historically close rel

The red flags women face in managing finances and how to deal with them

Many women have been accustomed to signing financial documents without full understanding, largely because they were not actively included in fin

Air India to operate extra UAE flights on March 8 for stranded flyers amid West Asia conflict

Move follows Saudi Arabia and Oman opening airspaces to maintain regular services

SBI, Tata Steel among top Nifty gainers of 2026 so far. How many do you own?

Despite a volatile start to 2026 with Middle East tensions and pressure on technology stocks, several Nifty 50 blue-chips have outperformed. SBI

Market trading guide: Data Patterns among 2 stock recommendations for Monday

Indian equities fell over 1% as escalating Middle East tensions pushed crude oil prices higher, weighing on sentiment. Analysts warn sustained oi

Who's Caitlin Kalinowski? OpenAI robotics chief resigns over Pentagon deal

Caitlin Kalinowski, the head of OpenAI's robotics team, has resigned from her position.

Trump downplays importance of Russia reportedly sharing intel with Iran to help it hit US targets

President also waved off a question about how Russia assisting Iran in such a way might affect his view of the US-Russia relationship

Oil imports in full flow: Hardeep Puri assures imports from non-Hormuz routes

India's oil imports are flowing smoothly through alternative routes, assuring citizens of uninterrupted energy supplies amid Middle East conflict

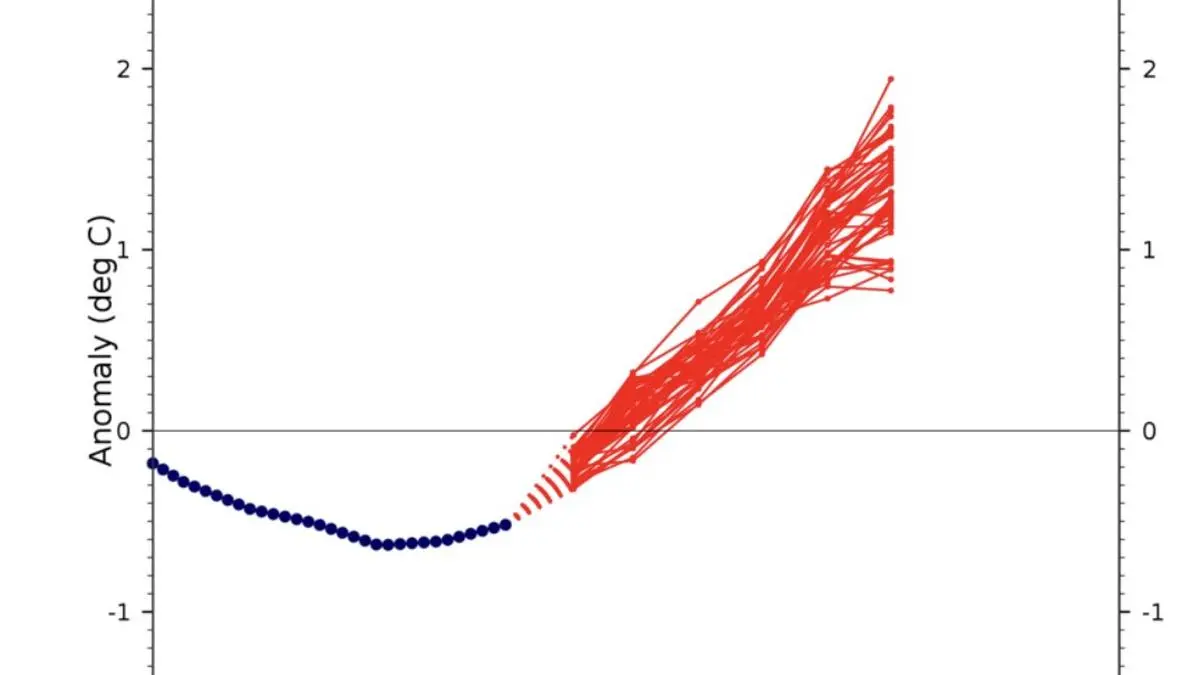

European forecaster projects El Nio to form by May, doesnt rule out super El Nio

The Pacific in east has already started warming, support from the atmosphere above is also unfolding

10 Large-cap stocks with massive upside potential - up to 60%! Do you own any?

China says US talks vital as Trump targets Beijing's key partners

With the US president focused on the war he and Israel launched against Iran, analysts are watching for signs that his visit to meet Xi will go a

Indian stock markets experienced a significant downturn. The Sensex and Nifty saw sharp declines in the first four March sessions. This selloff w

Can Indian dairy grow without growing milk volumes?

The real question before Indian dairy is not whether it can grow without milk volumes, but whether it can grow fast enough in quality without com

Milk as data: The untapped economic value in Indias dairy intelligence

The future of dairy in India can be based on understanding dairy rather than just producing it

10 penny stocks plunge up to 53% in a month - Are you affected?

Empowering rural India through commodity market access: A financial services perspective

Empowering rural India through commodity market access is a pragmatic approach, and not just a theoretical proposition

Clean farming, clean eating: The role of organic millets in building better protein diets for women

To ensure these products are genuinely advantageous, nutritionists are promoting the need for clear labelling and independent laboratory testing

India's economy is booming, but uneven growth clouds ascent

India's economy is booming, fueled by a strong services sector attracting global firms. This growth is making India a major economic power. Howev

Choice over tradition: What todays diamond buyer really wants

Todays consumers are comfortable embracing technology-driven innovation across sector

India's energy imports are flowing smoothly from non-Hormuz routes, ensuring citizens' needs are met amidst global market uncertainty. Qatar has

Trump rejects settling Iran war, raises prospect of killing all its potential leaders

US President Donald Trump said he is not interested in negotiating with Iran and suggested the war could end only if Tehrans military and leaders

Looking for higher FD returns? Check how much interest rates top NBFCs offer in India

NBFCs usually provide fixed deposit rates higher than traditional banks, reaching up to 7-8%. Here's how much interest rate top financial institu

Women and inheritance: What the law says about your property rights

Owning property is key to financial security, yet many women still miss out on their rightful inheritance. Heres what the law provides and the st

Indian corporates likely to continue capex investment despite West Asia conflict: Siemens MD

Starting that his companys growth plans were in line, Sunil Mathur said the strategy was to double the volume in India within five years.

US deal likely to be worked out in 3-4 months: Officials

India is poised to finalize trade deals with the US within months, pending clarity on American tariff strategies. New Delhi remains committed, ai

Why does the Strait of Hormuzs closure matter?

Where is the Strait of Hormuz and what is its significance? Why have tensions in West Asia affected this passage? What does Iran have to do with

India doesn't need permission to buy Russian oil, say officials

India continues to source crude oil from Russia, asserting its right to procure from any supplier based on national interest, affordability, and

LPG, LNG and Indias production, supply and distribution | Explained

Globally, LNG and LPG prices float with crude oil prices.Crude oil priceshave increasedbynearly $20per barrel in March alone an increase ofnearl

Govt grants relaxation to fulfil export obligation

Exporters receive significant relief from the government. Authorisations under Advance and Export Promotion Capital Goods schemes are automatical

In Asia, India secured best trade deal with US: Piyush Goyal

India has secured the best trade deal with the United States among its competitors. Commerce and Industry Minister Piyush Goyal highlighted the s

Govt. mulling deploying Indian Navy to escort ships stranded in Persian Gulf: Govt. source

Decision likely in two days; govt source says Iranian promise of not attacking neighbours may facilitate ship movement across Strait of Hormuz

Go Digit General Insurance gets GST demand notice of Rs 170 cr

India mulling coconut oil distribution via ration shops instead of palm oil

Government fine-tuning details of coconut promotion scheme, says Minister for Agriculture and Farmers Welfare Shivraj Singh Chouhan

Telangana govt to collect professional tax from private schools, faculty

Hyderabad: The Telangana government is planning to levy a professional tax on the 11,000-odd private unaided schools and their teaching staff wit

Iran not Indian corporates top priorities days ahead of attack

In the research report which summarised the speeches of top executives of the participant companies, Iran was mentioned only once and was not par

When to talk to AI chatbots about mental healthand when to stay far away, professionals say

Some Americans are using AI chatbots for therapy. Mental health experts share when it is, and isn't, safe to use those tools for emotional suppor

Parents who prioritize boosting their kids' confidence are setting them up for a lifetime of success, says mental performance coach Cindra Kampho

While the amount that a median-income household can afford is higher than it was a year ago, it is still below the median price for a single-fami

Indias Coconut Development Board moots distribution of coconut oil via ration shops

Government fine-tuning details of coconut promotion scheme, says Minister for Agriculture and Farmers Welfare Shivraj Singh Chouhan

West Asia Turmoil: India raises LPG prices a day after invoking emergency powers to boost production

Effective Saturday, non-PMUY consumers will have to shell out 913 for a 14.2-kg cylinder in Delhi and PMUY consumers will have to pay 613 per cyl

Indian refiners are buying both sanctioned and non-sanctioned Russian oil following US waiver

On Friday, US Treasury Secretary Scott Bessent said Washington would allow a 30-day waiver for Indian refiners to purchase Russian oil stranded a

Beyond the canvas: The women shaping Delhis Art market

From artistic curation to taking creative punts, women gallery owners are showing how to be successful artpreneurs

IndiaUS trade ties: Piyush Goyal says India secured best deal among competing nations

Just as the Russia - Ukraine war impacted food and fertiliser production, the ongoing war in West Asia is impacting trade and energy prices

CBI registers fresh bank loan fraud case against RCom, Anil Ambani, and others

They have been accused of cheating Punjab National Bank and the erstwhile United Bank of India, since merged with PNB, causing a loss of over 1,0

Gulf crisis threatens one-fifth of Indias farm exports: GTRI report

Cereals, especially rice, fruits, vegetables, spices, meat, dairy and beverages are all likely to be affected if the war goes on for a longer per

India England semi-final match at T20 World Cup sets new global digital viewership record

The previous digital global record was65 millionset by an international streaming platform in November 2024,afigureachievedthroughaggregatedviewe

Indo-US trade talks reset; deal now expected in 3-4 months

India to assess whether the deal still makes sense

Amit Shah inaugurates third sulphuric acid plant at IFFCOs Paradeep unit in Odisha

Foreign investors pull 20,800cr from India markets

Foreign portfolio investors (FPIs) have pulled out a whopping 20,818.71 crore (nearly $2.29 billion) from Indian markets in the week ending March

West Asia conflict threatens Indias $11.8 billion agri exports: GTRI

India's agricultural exports to West Asia are under serious threat due to escalating regional conflicts. The turmoil is thwarting shipping routes

130 Maoists surrender before Telangana CM Revanth Reddy along with weapons

They handedover 124 weapons to the police including LMG and AK-47 rifles

SBI rolls out $500 million social loan programme for women empowerment

State Bank of India has launched a USD 500 million syndicated social term loan focused on women empowerment, marking a significant step in ESG fi

Dalal Street Week Ahead: Defensive, stock-specific approach advised to protect gains

Indian markets experienced a sharp downturn this week, with the Nifty closing significantly lower and testing a crucial 100-week moving average s

'Indias energy stock position improving': Govt says petrol and diesel prices will not rise

India has secured the best trade deal with the United States. Minister Piyush Goyal stated this at the Raisina Dialogue 2026. He highlighted the

Government announces standards of green ammonia, green methanol

The notification further provides that carbon dioxide for green methanol production may be sourced from biogenic sources, direct air capture or e

West Asia crisis: Ministry asks ports to consider waiving charges, issues SoP

As part of the SoP, each port will appoint a nodal officer at the level of head of department, who will be the single point of contact for addres

34 C

34 C