Tamil Nadu / Bloomberg Quint

As an unskilled labour, the convict would be paid a daily wage of Rs 105, the official of the Presidency Correctional Home said.

Over-capitalisation, digital ban and Activmoney dependence can be overcome, says the brokerage.

Amid ongoing volatility, it is crucial to invest in a disciplined manner, Maneesh Dangi said.

US yields & crude price might be key reasons for fear in Indian markets, says Carnelian Asset Management & Advisors Vikas Khemani.

The small-cap benchmarkNSE Small Cap 250has tumbled over 6.40% in the first nine sessions in 2025, the highest in any year.

Of the 12 banks in the Nifty Bank sector, only Axis Bank, IDFC First Bank, and IndusInd Bank managed to stay in the green.

Do not see the market falling below 22,000 and sustaining below 22,000 for a long period of time, Sonthalia said.

Post the revision in gold imports data, the merchandise trade gap narrowed to approximately $32.8 billion from $37.8 billion in November

Recent stock drops offer attractive entry points in an NBFC with high-calibre management, many legs of growth and 2.5% RoA, says Anand Rathi.

Zomato is set to bring in an inflow of $513 million, or approximately Rs 4,356 crore, post its inclusion in the Sensex, Nuvama said.

Although Dabur's near-term performance appears challenging, the recent stock correction has largely factored in the same, says the brokerage.

The share price of Reliance Industries has fallen 14.8%, while Tata Motors has corrected over 28% since July 27, the start of the August derivative contract.

Motilal Oswal reiterates its overweight stance on the staple segment and continue to prefer HUL, Godrej Consumer, and Dabur as its top picks.

Strong balance sheets across sectors is boosting this confidence, he said.

Damodaran said that the seven megacaps including chip giant Nvidia are insanely profitable and he owns all of them.

Kelkar advised against expecting high returns from market indices, citing slowing earnings growth and unappealing market valuations.

Marcellus Investment's Pramod Gubbi points to private sector financials as a pocket of value in the current market scenario.

Looking ahead, a potential recovery in public capex and rural demand in the second half of the year are positives, Citi said.

All the 12 sectoral indices on the NSE ended lower, with the Nifty PSU Bank and Realty declining the most.

Global funds havesold stocksworth over Rs 1.50 lakh crore since Sept. 27, according to provisional data from the NSE.

The relatively inexpensive private sector banks have started to outperform of late, amid expectations of a potential rate cut by the RBI, Wood noted.

The best Nifty Midcap-100 performers in October 24 were BSE,, Indian Bank,, Coforge, Max Financial, and Hindustan Zinc, adds the brokerage.

Anand Rathi also highlighted the growth in retail investors and said people are getting more educated about investment and asset classes.

The ongoing Samvat 2080 has seen significant fluctuations in stock markets. Experts provide crucial insights on market volatility and effective Muhurat trading strategies as we approach Samvat 2081.

The brokerage maintains its FY25-27E and remain constructive on the companys growth potential.

Rajiv Batra noted that recent uncertainties surrounding the U.S. elections have led many investors to shift their focus toward dollar-denominated assets.

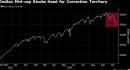

Nifty Midcap 100 tumbled as much as 2.9% Friday, extending its drop from recent high to more than 10%.

IndusInd Bank shares dropped nearly 20% in trade, as Q2 net profit fell 40%.

Tech Mahindra, Trent, Infosys, HCLTech, Kotak Mahindra Bank and HDFC Life Insurance shares have gained even as 40% of the Nifty stocks have entered correction.

Sinha also advised investors to be cautious of investing in realty firms, suggesting that the recent strong performance is likely to be impacted by external pressures.

The benchmark Nifty 50 hit an all time high of 26,277.35 on Sept. 27. Since then the benchmark has pulled back 5% from the milestone.

While Indian IT companies improved in the June quarter, elevated full-year expectations might prove hard to beat.

Markets are internally correcting, even while touching life highs, Shah said.

Jefferies expects a decline in operating profits for Dabur, although peers may not experience the same downturn.

15 C

15 C