RBI's additional liquidity support to wind down after March, bankers say

The RBIs recent liquidity infusion, which has pushed overnight rates below the repo rate to ease funding stress, is seen

Negligible chance of rate hike in near term: RBI MPC Member

MUMBAI, Feb 25: Chances of benchmark interest rate going up are negligible notwithstanding building up of inflationary p

Geopolitical heat lifts inflation fears but RBI's repo rate hike unlikely

RBI MPC member Saugata Bhattacharya says a rate hike is negligible despite inflation risks from crude, metals and weathe

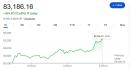

Mumbai: After falling for three straight sessions, the Indian stock market bounced back on 16 February with strong buyin

New Delhi : The overall residential market in India continues to exhibit underlying resilience, supported by a stable ma

INR extends gains amid weak dollar overseas; Positive cues from equities support

The Indian rupee is extending gains against the dollar in opening trades on Monday, tracking weakness in dollar overseas

Inflation needs monitoring in FY27 as new CPI series kicks in: SBI Research

The Reserve Bank of India's monetary policy decisions for 2026-27 will depend on inflation trends. A new Consumer Price

Late buying powers benchmarks higher as RBI steadies sentiment

The domestic equity benchmarks clawed back a portion of the previous sessions losses in a choppy trade on February 6 as

Post-budget review: RBI maintains rate pause at 5.25%

The RBI has paused policy rates after Decembers 25 bps cut, keeping the repo rate unchanged at 5.25% in its first review

Interest rates to remain at low level for long period of time: RBI Governor Sanjay Malhotra

Repo rate remains unchanged at 5.25%, neutral stance

RBI Keeps Repo Rate Unchanged at 5.25%, Maintains Neutral Stance as Inflation Eases

RBI keeps the repo rate unchanged at 5.25% and retains a neutral stance, citing easing inflation, strong fundamentals an

RBI keeps rates, stance unchanged amid evident risks to global trade

The Reserve Bank of Indias monetary policy committee on Friday unanimously kept the repo rate unchanged at 5.25% and ret

RBI pauses rate cuts, retains interest rate at 5.25 pc

New Delhi, Feb 6 (PTI) After a 25 basis point rate cut in December, the RBI on Friday decided to pause on the policy rat

RBI MPC meet February 2026: Read the full statement by Governor Sanjay Malhotra here

RBI MPC statement: The Reserve Bank of India's Monetary Policy Committee maintained the repo rate at 5.25% and a neutral

RBI Keeps Repo Rate Unchanged At 5.25%, Maintains Neutral Stance Amid Global Policy Divergence

MUMBAI, Feb 6: Reserve Bank of India (RBI) Governor Sanjay Malhotra on Friday announced that the Monetary Policy Committ

RBI MPC keeps repo rate unchanged at 5.5%

RBI Governor Malhotra said that domestic inflation and growth outlook remain positive and added that the Indian economy

RBI Keeps Repo Rate Unchanged At 5.25%

With the repo rate unchanged, the Standing Deposit Facility (SDF) rate remains at 5 per cent, while the Marginal Standin

RBI Monetary Policy Committee keeps repo rate unchanged at 5.25%

RBI MPC: India's trade deals give Sanjay Malhotra & Co cover to hold repo rates steady at 5.25%

The Reserve Bank of India kept the repo rate unchanged at 5.25% on Friday, in line with expectations, after recent gover

RBI MPC Meeting 2026-27 Key Takeaways: Repo rate, GDP & inflation targets

RBI Monetary Policy Meeting 2026-27 Key Takeaways: RBI MPC will announce its latest policy decision on Friday. This deci

RBI MPC meeting time: The Reserve Bank of India's Monetary Policy Committee will announce its latest policy decision on

RBI MPC at a glance: Your one-stop guide for all key decisions

RBI MPC Meeting at a Glance: The Reserve Bank of India is likely to hold the repo rate steady this Friday. Global uncert

RBI MPC Meet Feb 2026 Date & time: The Reserve Bank of India's Monetary Policy Committee is meeting to decide on interes

The Reserve Bank of India's Monetary Policy Committee is expected to hold interest rates steady. Global economic uncerta

RBI MPC begins rate meeting, decision due Friday

The Reserve Bank of India's Monetary Policy Committee has started discussions on interest rates. Experts anticipate a pa

RBI likely to hold repo rate, maintain neutral stance in upcoming MPC review: Nuvama Report

RBI Monetary Policy Committee 2026: The Reserve Bank of India is anticipated to hold its policy repo rate steady. A neut

As Indian consumers increasingly prioritise speed, transparency, and ease of use in their financial decisions, banking i

RBI to slash rates by 0.25 pc next week in this cycle's last cut: Report

A foreign brokerage anticipates the Reserve Bank of India will cut the repo rate by 0.25% on February 6, marking the fin

Highest ever Retail disbursements for the third quarter ended December 31, 2025 (Q3FY26) at Rs. 22,701 Crore, up 49% Yea

CII's Biz Confidence Index climbs to five-quarter high in Q3 FY26

Business confidence in India is soaring, reaching a five-quarter high. Firms are optimistic about demand, profitability,

Budget 2026: How India can mobilise capital for its next growth leap

Union Budget: Policy and regulatory support helped boost consumption in 2025, reflected in strong GST collections and hi

Govt keeps small savings interest rates unchanged for March quarter

Government has maintained interest rates for twelve small savings schemes, including PPF and Sukanya Samriddhi, for the

From Gurugram Homes to Noida Offices: NCR's Real Estate Story in 2025

Housing emerged as the defining force behind NCRs real estate recovery in 2025, setting the tone for a more measured and

2025: Govt policies give wings to Indian Real Estate

KOLKATA, Dec 27: Proactive government interventions and supportive monetary policies in 2025 emerged as a powerful catal

Business events that shaped India in 2025

From Trumps trade war to RBI repo rate cuts and major corporate entries, 2025 delivered several notable developments. Th

RBI neutral stance will enable actions as per macro-economy

PTI Mumbai RBI Governor Sanjay Malhotra has said that a neutral monetary policy stance would give flexibility to the cen

RBI Gov Votes For Rate Cut On Benign Inflation, Risks To Growth

The RBI cut the repo rate by 25 basis points (bps) to 5.25 per cent on December 5, citing a rare goldilocks period where

The Reserve Bank of India's monetary policy committee decided on a 25 basis points repo rate cut. This move was driven b

Leading public, private banks cut home loan rates after RBI slashes repo rate

NEW DELHI, Dec 9: After the Reserve Bank of India (RBI) cut down the major policy rate by 25 basis points to 5.25 percen

Nationalised Banks Cut Loan Rates After RBIs Repo Rate Cut

Banks offer a spread on the repo rate based on the borrowers profile

Repo Rate Slashed to 5.25 percent; Softer Rate Cycle Reignites Demand Across Real Estate Sector

The Reserve Bank of India (RBI) has unanimously cut the repo rate by 25 basis points, bringing it to 5.25 percent. This

RBI did its part, now time for markets to show maturity: SBI report

The Reserve Bank of India has reduced the repo rate to boost economic growth. This move comes as India experiences stron

Bank of Baroda cut repo-linked interest rate, others to follow suit

NEW DELHI, Dec 5: Hours after the RBI slashed key policy rate, state-owned Bank of Baroda announced an interest rate cut

Home, Auto Loans to Get Cheaper at RBI Cuts Repo Rate

All other loans with fixed rates of interest will not fall. These include personal loans which are of short duration and

RBIs New Year Gift To Borrowers, Cuts Lending Rate By 25 bps

The rate-setting panel, the Monetary Policy Committee (MPC), retained its neutral policy stance. With this cut, the MPC

RBI Governor Malhotra expects deposit rates to moderate along with lending rates

Reserve Bank of India Governor Sanjay Malhotra anticipates deposit rates will decrease, mirroring falling bank lending r

RBI rate cut to enhance affordability, aid further growth of auto industry: SIAM

NEW DELHI, Dec 5: The RBI decision to cut interest rate by 25 basis points, along with recent GST reforms, would further

RBI unanimously decides to reduce repo rate to 5.25 pc maintaining neutral stance

Mumbai, Dec 5: The Reserve Bank of India (RBI) Monetary Policy Committee (MPC) on Friday unanimously decided to reduce t

RBI cuts repo rate by 25 bps to 5.25% as inflation provides a headroom

The Reserve Bank of India's Monetary Policy Committee has reduced its key repo rate by 25 basis points to 5.25%. This mo

RBI Slashes Repo Rate By 25 Basis Points Amid Rupee Slump: What It Means

The repo rate is the interest rate at which commercial banks borrow money from the RBI by pledging government securities

Why RBI MPC cut key rates today amid tricky growth-inflation mix

The Reserve Bank of India cut the repo rate by 25 basis points, bringing it to 5.25%, citing record-low retail inflation

RBI cuts repo rate by 25 basis points, boosts liquidity

MUMBAI, Dec 5 (Reuters) The RBI (Reserve Bank of India) cut its key repo rate by 25 basis points on Friday, in line wit

RBI Cuts Key Rate By 25 Bps To 5.25% Amid Robust GDP Growth, Record Low Inflation

Mumbai, Dec 5: The Reserve Bank of India on Friday announced a 25 basis points reduction in the policy repo rate, bringi

RBI MPC 2025: Rupee firms as forex reserves rise to $686 billion

India's foreign exchange reserves have climbed to $686 billion. This provides a strong 11 months of import cover. The Re

MPC cuts repo rate by 25 basis points to 5.25%

Inflation at a benign 2.2% and growth at 8%, for the first half of this year presents a rare goldilocks period, RBI Gove

RBI cuts Repo Rate by 25 basis points to 5.25%

India's GDP growth exceeded the RBI's expectations in both the June and September quarters. In the July-September quarte

RBI MPC cuts repo rate by 25 bps to 5.25%, maintains neutral stance

Latest Monetary Policy Committee meeting updates: The RBI's Monetary Policy Committee cut the policy repo rate by 25 bas

Big cash crunch? Banks tap $26 billion Fed Repo lifeline second-highest since 2020 crash

U.S. banks tapped the Feds Standing Repo Facility for $26 billion, the second-highest since 2020, as liquidity tightened

RBI likely to keep repo rate unchanged at 5.50% in December policy: BoB

As December 5th approaches, the Reserve Bank of India is likely to keep the repo rate unchanged at 5.50 percent, signali

RBI MPC Meet 2025: Date, time, and where to watch Governor Sanjay Malhotras policy statement

The RBI's Monetary Policy Committee meets amid strong economic growth and record low inflation. Governor Sanjay Malhotra

The Reserve Bank of India is anticipated to maintain its repo rate at the upcoming December Monetary Policy Committee me

SBI confident of achieving 3 pc NIM target even if RBI cuts rate next week: Chairman Setty

NEW DELHI, Nov 26:State Bank of India is confident of achieving its 3 per cent net interest margin guidance even if the