Diversifying production is an essential part of any global company’s strategy, and Apple is no different in its efforts to spread out the production of its devices. In recent years, the Cupertino company has been gradually moving smartphone production, especially the iPhone, to India. This move has wide-ranging economic and social impacts, affecting pricing, product quality, operating costs, profits, and financial indicators, as well as sales.

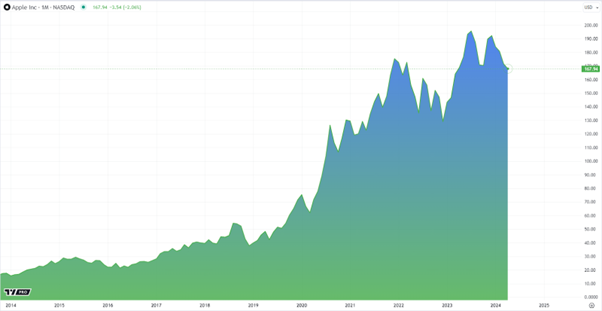

Moving production to India could potentially cut labor and ancillary costs, as wages in India are lower than in China. This could allow Apple to offer some iPhone models at more competitive prices, especially in the Indian market, where high taxes are imposed on imported electronics. One in seven Apple iPhones is already assembled in India, indicating a significant shift. Last year, iPhones worth a total of $14 billion were manufactured there. It’s akin to free market replay to see how Apple stock reacted to the manufacturing boom in the early years in China. According to local authorities, the production migration has already created 150,000 jobs at local Apple contractor enterprises.

However, it’s worth noting that Apple maintains strict quality standards, and relocating production doesn’t necessarily mean a drop in quality. The company will uphold rigorous quality control at all production stages, regardless of location. Initially, moving production facilities may require substantial investments, such as construction of new plants and training workers. However, in the long run, lower labor and logistics costs could boost the company’s profit margin.

By developing more affordable versions of its devices for emerging markets, Apple can significantly expand its customer base and sales, positively impacting its financial performance. A stronger presence in the Indian market could also boost sales, offering a direct route to bypass high import duties.

The main reason why Apple is steering clear of concentrating production in China is the ongoing trade war between the United States and China. This has resulted in higher tariffs and uncertainty regarding business regulations. Consequently, rising wages in China diminish the advantage of low production costs. Moreover, spreading production across different countries helps mitigate political and economic risks. Manufacturing directly in India also provides better access to the vast domestic market and avoids high tariffs.

Besides, in the first quarter of 2024, Apple experienced a decline in global smartphone shipments, facing competition from Chinese companies such as Xiaomi. iPhone shipments dropped by 9.6% compared to the previous year, totaling 50.1 million units. Consequently, Apple’s market share decreased to 17.3%, accompanied by a 5.6% decline in Apple stock during the same period.

For China, the partial loss of Apple’s production could have adverse effects, especially in the short term, reducing employment and tax revenues. Nevertheless, China remains an important global manufacturing hub with a robust ecosystem of suppliers and manufacturers. On the contrary, the influx of significant investments from global tech giants such as Apple benefits India by creating jobs, boosting exports, and fostering the growth of the tech sector, leading to substantial positive economic outcomes.

A complete shift of iPhone production to India may be somewhat unrealistic, given the complexity and scale of the current production network in China. It’s more likely that Apple will aim to distribute production facilities across several countries to minimize risks and optimize costs, enhancing business resilience to political and economic fluctuations.

Overall, this is a prudent strategic move that could yield numerous benefits for both Apple and the Indian economy. While it may pose challenges for China in the short term, both countries are expected to maintain key roles in the global manufacturing and economic landscape.

Photo by Dollar Gill on Unsplash (Free for commercial use)