The Indian economy has witnessed an influential shift towards a cashless society in recent years. This digital transformation has been driven by several factors. These include the growing popularity of smartphones, government initiatives, and the increasing adoption of digital payment methods.

Moreover, the ease and convenience it has brought has been a real game-changer. Even the statistics have suggested a massive growth of payments via merchant QR codes, which is by 590%. While its benefits continue to make it a popular payment method, it is also becoming commonly used by shopkeepers and businesses, irrespective of their scale.

Now, the big question is, are they really the key to a cashless economy? Well yes. Now, let’s find out how.

What are Merchant QR Codes?

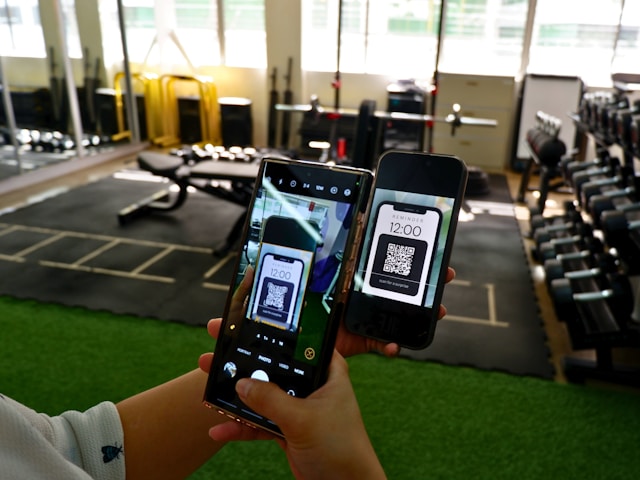

A merchant QR code (also known as a static QR code) is a unique, scannable code displayed by a merchant at their shop or online store. Customers scan the QR code, which will take them to the payment gateway. Afterward, they can complete the transaction using various digital payment methods like UPI, mobile wallets, or net banking. Now, let’s look at what they bring to the table.

Benefits of Using Merchant QR Codes for SMEs

From empowering them to cruise through the digital landscape to making their operations seamless, QR codes have several advantages for SMEs. Here are some of their benefits worth knowing about:

- Increased Efficiency and Speed

Accepting payments through merchant QR codes streamlines the checkout process. Transactions are completed quickly and efficiently, leading to shorter queues and improved customer experience. It helps save valuable time for both you and your customers.

- Wider Customer Reach

By offering QR codes as a payment option, you cater to the growing segment of customers who prefer cashless transactions. As a result, it helps attract new customers and boost your sales potential.

- Cost-Effective Solution

Setting up QR codes from reputed SME banks is significantly cheaper than traditional point-of-sale (POS) systems. Embracing cashless transactions without incurring significant costs makes it an attractive option for small and medium enterprises (SMEs).

- Secure and Reliable Transactions

Merchant QR codes utilise secure payment gateways that encrypt sensitive customer information, ensuring safe and reliable transactions. This minimises the risk of fraud associated with cash handling.

- Easy to Set Up and Use

Installing and utilising QR code machines is a simple process, especially if you have a reliable SME bank’s support. You can easily generate a unique code through various online platforms or mobile applications offered by banks and payment service providers. Once generated, you can display the code prominently at your store or online platform for customer visibility.

- Real-time Transaction Tracking

Most merchant QR code solutions offer real-time transaction tracking and reporting features. This allows you to monitor your sales activity, analyse customer behaviour, and gain valuable insights to make informed business decisions.

- Reconciliation Made Easy

With these QR codes, transaction records are automatically generated and stored electronically on the ePOS machines. This simplifies your reconciliation process, saving you time and effort compared to manual record-keeping practices.

- Improved Inventory Management

Merchant QR codes can be linked to your inventory management system using ePOS machines. This, in turn, allows for real-time stock updates whenever a sale is made. Additionally, this helps you maintain accurate inventory levels and avoid stock-outs.

- Adaptable to Different Business Models

Whether you run a hardware repair store, an online business, or operate as a mobile vendor, QR codes are a versatile solution. They can be easily leveraged and adapted for use in any business model.

How do SME Banks Help Embrace QR Codes?

Recognising the numerous benefits of QR codes, banks are actively promoting this technology for SMEs. Here’s how they can assist you in leveraging QR codes and empowering your businesses:

- Tailored Solutions

SME banks understand the unique needs of small and medium enterprises (SMEs), which allows them to offer tailored QR code solutions for them. Whether it’s custom branding or integration with accounting software, they provide comprehensive support to ensure a seamless experience.

- Educational Initiatives

Many banks conduct workshops and training sessions to educate businesses about the advantages of Merchant QR codes. By raising awareness and demystifying the technology, banks empower businesses to embrace cashless transactions confidently.

- Streamlined Processes

Banks streamline the onboarding process for Merchant QR code services, making it quick and straightforward for businesses to start accepting digital payments. From account setup to technical support, banks offer end-to-end assistance every step of the way.

- Competitive Pricing

Banks offer competitive pricing plans for their SME services, ensuring affordability for businesses of all sizes. Transparent fee structures and flexible payment options further enhance the appeal of these solutions.

Get Your Merchant QR Code Today!

As technology evolves, QR codes are expected to become even more sophisticated and integrated with other digital payment solutions. With features like dynamic codes for personalised transactions and integration with e-invoicing systems, merchant QR codes are poised to play a vital role in making India cashless.

To leverage their benefits with full potential, partnering with a reputed bank like HDFC Bank is more than necessary. HDFC Banks offers a unique set of SME services that includes the SmartHub Vyapar app. This mobile app is for SMEs to easily gain access to their merchant QR codes and get ahead of their competition. Download HDFC Bank’s SmartHub Vyapar App from the Google Play Store or Apple Store today!

Photo by Marielle Ursua on Unsplash (Free for commercial use)