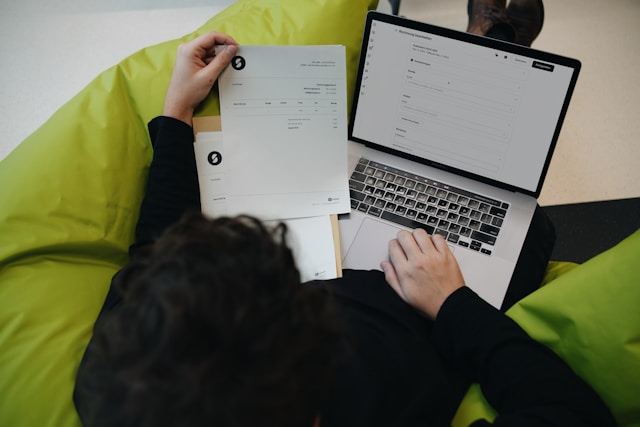

In today’s fast-moving world, small businesses need to manage their bills fast and correctly. Getting paid on time and keeping records straight is a big part of staying successful. But many businesses still use old paper billing methods. These slow things down and can cause mistakes.

Customers now prefer faster and easier ways to pay. That’s why moving to an electronic invoice system is a smart step. It lets you make, send, and track your invoices online. This saves time, avoids errors, and gets you paid faster.

You can make things even better by using Smart Accounting Software with your billing setup. This software pulls together your sales, spending, taxes, and reports in one place. It cuts out double work and helps you stay organized.

So, using an electronic invoice system with Smart Accounting Software gives you better control, easier tax filing, and more free time. Instead of sorting through piles of paper, you can focus on growing your business and keeping your customers happy.

Why Use an Electronic Invoice System?

Switching to a digital billing tool is more than just saving paper. It can truly help your business grow. Here are major reasons to go digital:

1. Save Money

Printing, mailing, and storing paper invoices costs money. Digital invoices cut these costs. The savings can be used to grow your business, like building a website or hiring help.

2. Work Faster

Online systems let you send many invoices at once. No more typing or mailing each bill by hand. You can also set up reminders for your customers. This means less waiting and chasing payments.

3. Fewer Mistakes

When you write things by hand, it’s easy to make errors. Digital systems fill in tax and total amounts for you. This means fewer mix-ups and fewer upset customers.

4. Stay Compliant with Rules

India’s GST system has many rules. Electronic invoice systems handle GST formats and taxes for you. This helps you file correctly and avoid fines.

5. Keep Your Data Safe

Paper files can be lost or damaged. Online invoices are stored in the cloud. They are locked with passwords, and only trusted people can view them.

—

What to Look for in a Billing System

Not all e-invoice tools are the same. Pick one that suits your needs:

a. Easy to Use

The tool should be simple enough for anyone to use. Look for clean layouts and help tips.

b. Works with Other Tools

Your billing system should talk to your accounting, payment, and customer software. This saves time and keeps your data accurate.

c. Mobile Access

Look for an app! You should be able to send invoices from your phone—anywhere, anytime.

d. Custom Look

Your bills should show your logo and brand colors. A personal touch builds trust.

e. Instant Updates

Live tracking tells you who has paid and who hasn’t. Reports help you plan better and manage cash.

—

Steps to Start Using an E-Invoice System

Going digital takes planning. Follow these steps to get started:

1. Know What You Need

Think about what’s not working. Are your payments late? Is paperwork a mess? Knowing your problems will help you pick the best tool.

2. Pick the Right Tool

Look for one that fits your budget and offers local features. Vyapar is a top choice for Indian small businesses. It supports GST, easy payments, and much more.

3. Teach Your Team

A tool is only good if people know how to use it. Share short guides or videos. Let your staff try things and ask questions.

4. Move Your Old Data

Before switching, back up your old records. Then upload them into the new system. Many tools, like Vyapar, walk you through this process.

5. Do a Test Run

Try it with a few real invoices. Check that they send, track, and record correctly. Make small changes if needed before going fully live.

—

Why Indian SMEs Trust Vyapar

Vyapar is built for small Indian businesses. It does more than billing—it helps manage your entire business.

Here’s what makes Vyapar stand out:

– Fully GST-ready with automatic tax settings

– Make and send invoices via WhatsApp or email

– Track stock levels and get alerts

– Use Smart Accounting Software to manage expenses and reports

It works on both mobile and desktop. Even if you’re not tech-savvy, Vyapar is simple to use.

Mistakes to Avoid

Stay clear of these common slip-ups:

– No mobile access: You should be able to check bills on your phone.

– Wrong tool for your size: Choose software that grows with your business.

– No training: If your team isn’t trained, mistakes will happen.

– Not backing up: Always save your data safely.

– Forgetting customer needs: Some clients want PDFs, others prefer WhatsApp links.

Best Tips for Using Billing Software

To get the most out of your tools:

– Pick a mobile-friendly tool so you can work on the move.

– Use software that grows as you grow.

– Make sure your team knows how to use it.

– Keep your data backed up to avoid loss.

– Send invoices the way your customers like.

Image by SumUp on Unsplash (Free for Commercial Use)

Image published by on January 2, 2025