Over the past four years, Hong Kong has entered with a budget deficit exceeding US$20 billion. The city’s finance chief, Paul Chan, attributed this to “multiple internal and external challenges.”

This fiscal year, Hong Kong faces a budget deficit of HK$87 billion (US$11 billion). In an attempt to tackle the shortfall, Hong Kong’s government is implementing measures such as a HK$2 transport fare cut for those aged 60 and above, salary cuts for government employees, and a 7% cut in civil services expenses.

Last year, Hong Kong collected only US$2.5 billion in taxes, compared to its peak of US$21.2 billion in 2018. The reason for that is a 30% decline in housing prices and fewer trades.

Another measure taken to boost investment inflows is the launch of the Hong Kong AI Research and Development Institute, worth HK$1 billion ($128 million US). This entity will support AI-related research and development, as well as industry applications, according to Chan.

This initiative follows US President Trump’s 10% tariffs targeting imports from China and Hong Kong. After the tariffs were enforced, Hong Kong’s chief secretary, the city’s number two official, said: “We will file a complaint to the WTO [the World Trade Organization] regarding this unreasonable arrangement.” He also claimed that the US has disregarded Hong Kong’s status as a separate customs territory. It also has its own representatives in many organizations, including the Financial Action Task Force and the Asia-Pacific Economic Cooperation Forum.

Trade tensions between China and the United States began years ago. Back in 2020, a new round of escalation followed the introduction of the national security law (NSL). Both Beijing and Hong Kong authorities argued that the law was necessary to keep peace and protect the citizens from the radicals.

Hong Kong’s officials follow Beijing’s principle of “one country, two systems,” first introduced in the 1980s during negotiations with Great Britain regarding the status of Macau and Hong Kong.

Since then, mainland China has not been heavily involved in the legislation or economic affairs of these cities, until the adoption of the law led to stricter measures.

The 2020 act heavily impacted Hong Kong’s autonomy. It states that if Beijing law conflicts with any Hong Kong law, Beijing law takes priority. Also, it strengthened management of foreign non-governmental organizations and news agencies and expanded powers for surveillance and wire-taping citizens suspected of breaking the law.

The passage of the NSL was followed by measures from the US government, which imposed financial sanctions on 42 officials from the People’s Republic of China and Hong Kong.

Recently, President Trump added an extra 10% tariff on Chinese imports, treating Hong Kong the same way as mainland China to combat drug smuggling into the United States.

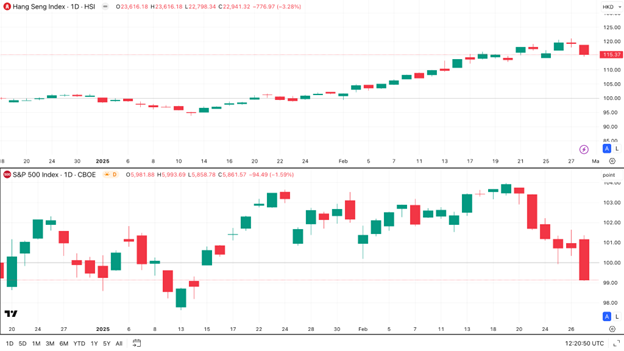

On the SPX chart below, the S&P 500 is compared with the Hang Send Index which tracks the Hong Kong companies listed on the Hong Kong exchange. It is clear that the recent global market downfall affected Hong Kong less than the US economy.

But, growing trade tensions raise concerns about Hong Kong’s economic future. If former allies start treating it the same way as the People’s Republic of China, will “one country, two systems” continue to exist?

Photo by Viktor Forgacs on Unsplash (Free for commercial use)

Image published on March 17, 2021

Image by https://www.tradingview.com