वैभव तनेजा को बनाया गया टेस्ला का CFO, भारतीयों का गर्व से किया सीना चौड़ा

अमेरिका की प्रसिद्ध इलेक्ट्रिक कार कंपनी टेस्ला आजकल भारत में काफी चर्चा का विषय बना हुआ है। इसी बीच टेस्ला ने भारतीय मूल के व्यक्ति वैभव तनेजा को कंपनी का CFO बनाने का ऐलान किया है। जानिए कैसे बने वैभव टेस्ला के CFO, उनकी योगदान से भरी कहानी और इस सफर में उनकी सफलता की […]

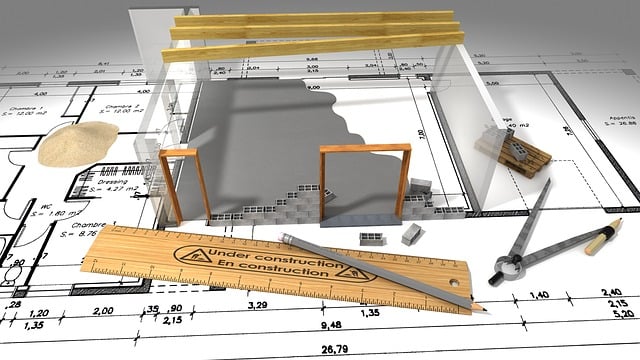

5 Potential Benefits of Building Information Modeling

Introduction Construction projects reap huge benefits from Building Information Modelling (BIM), a system for creating and managing relevant data. The technique results in a 3D building model representing the object to be constructed digitally before its physical construction begins. BIM is more than just using fancy software for building projects. Instead, it’s a comprehensive method […]

Mastering the Art of Lucrative Trading: The Ten-Year Roadmap

The global financial trading landscape often appears as a convoluted enigma for newcomers, an intertwining maze filled with intricacies, uncertainty, and a seemingly alien vernacular. However, for those who weather the storm, seeking to conquer this domain, the potential rewards can be phenomenal. Over the course of a ten-year expedition, it’s attainable to devise approaches […]

Why Corporate Gifts Matter in the Workplace?

Corporate gifts have emerged as a significant feature of the corporate world, acting as a potent tool for organisations to develop and solidify relationships with customers, partners, and staff. These considerate expressions of gratitude go beyond a mere act of kindness; they express gratitude, professionalism, and a dedication to the long term. All corporate gifts […]

Exploring the Fundamentals of Medical Billing and Coding

Medical billing and coding form the backbone of the healthcare industry, facilitating efficient and accurate payment processes for healthcare services. These two essential components ensure that medical practices receive appropriate reimbursement for the services they provide, while also maintaining compliance with various healthcare regulations. In this guest post, we will delve into the fundamentals of […]

Top Deductions That People Miss Out on While Filing Their ITR

Introduction As the deadline for ITR filing approaches, people attempt to identify all ‘Revenue from Sources’ and appropriately complete their reports. Taxpayers who filed returns under the previous tax system know the popular deductions available under different sections that reduce taxable income. Most of them strive to take advantage of the Section 80C limit as […]